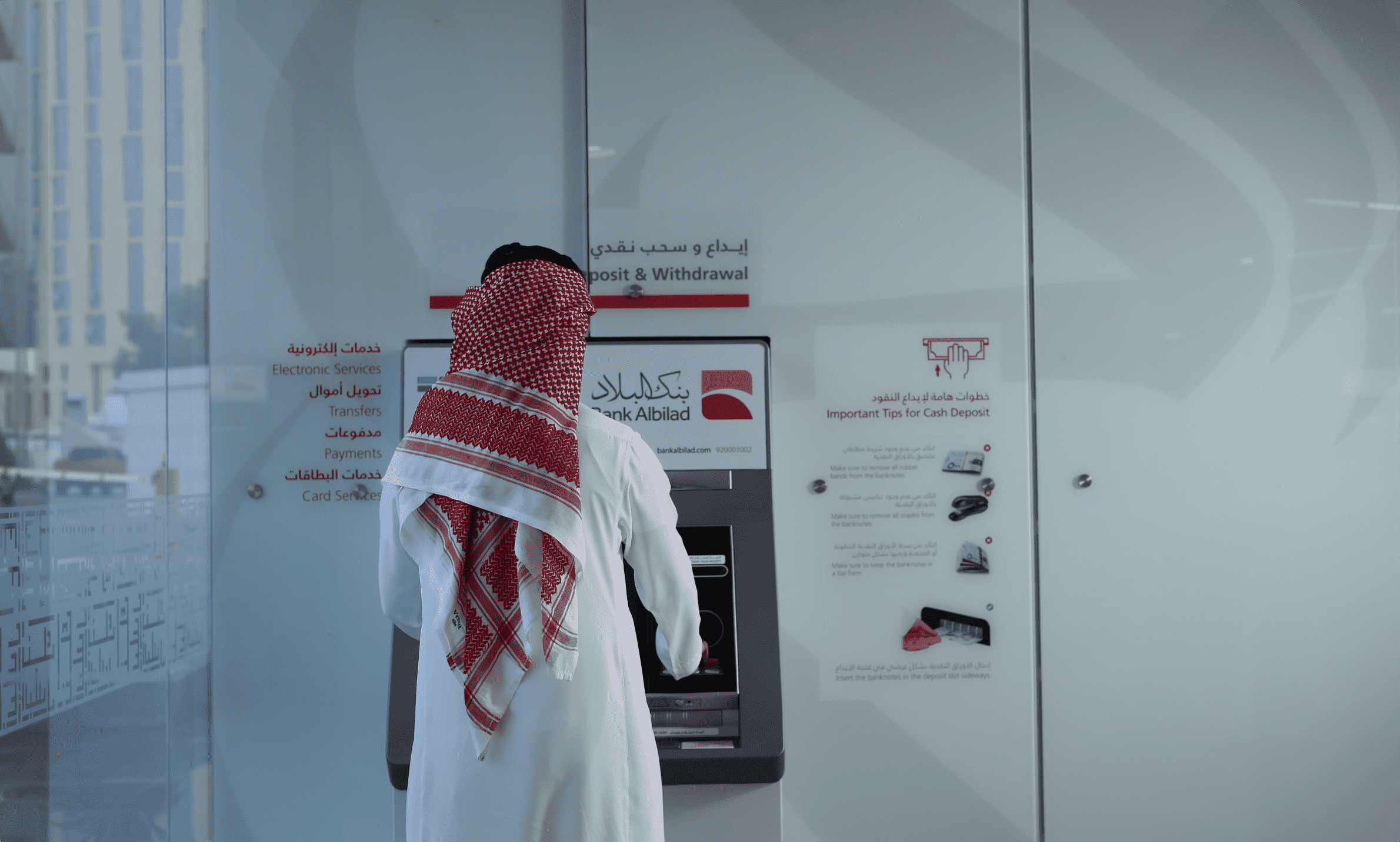

Introduction of Treasury Management System (TMS) became the base for further product development. It has provided an effective basis for managing risk and maintaining liquidity. This is vitally important for Treasury to position itself for next-generation banking.

In 2023, we have built on this foundation with the introduction of new investment structures that will enable increased diversification of Treasury revenue in the years ahead. This year we witnessed exponential growth in Bank Albilad’s Term Deposit Wakalah customer base and book size. As we move forward into 2024, consolidating and maintaining this growth will be a key priority.

We have adopted a robust and stringent approach towards governance and compliance, ensuring that all products and services are Sharia-compliant. Additionally, our portfolio and activities remain within both regulatory ambit and the bank’s internal risk appetite.