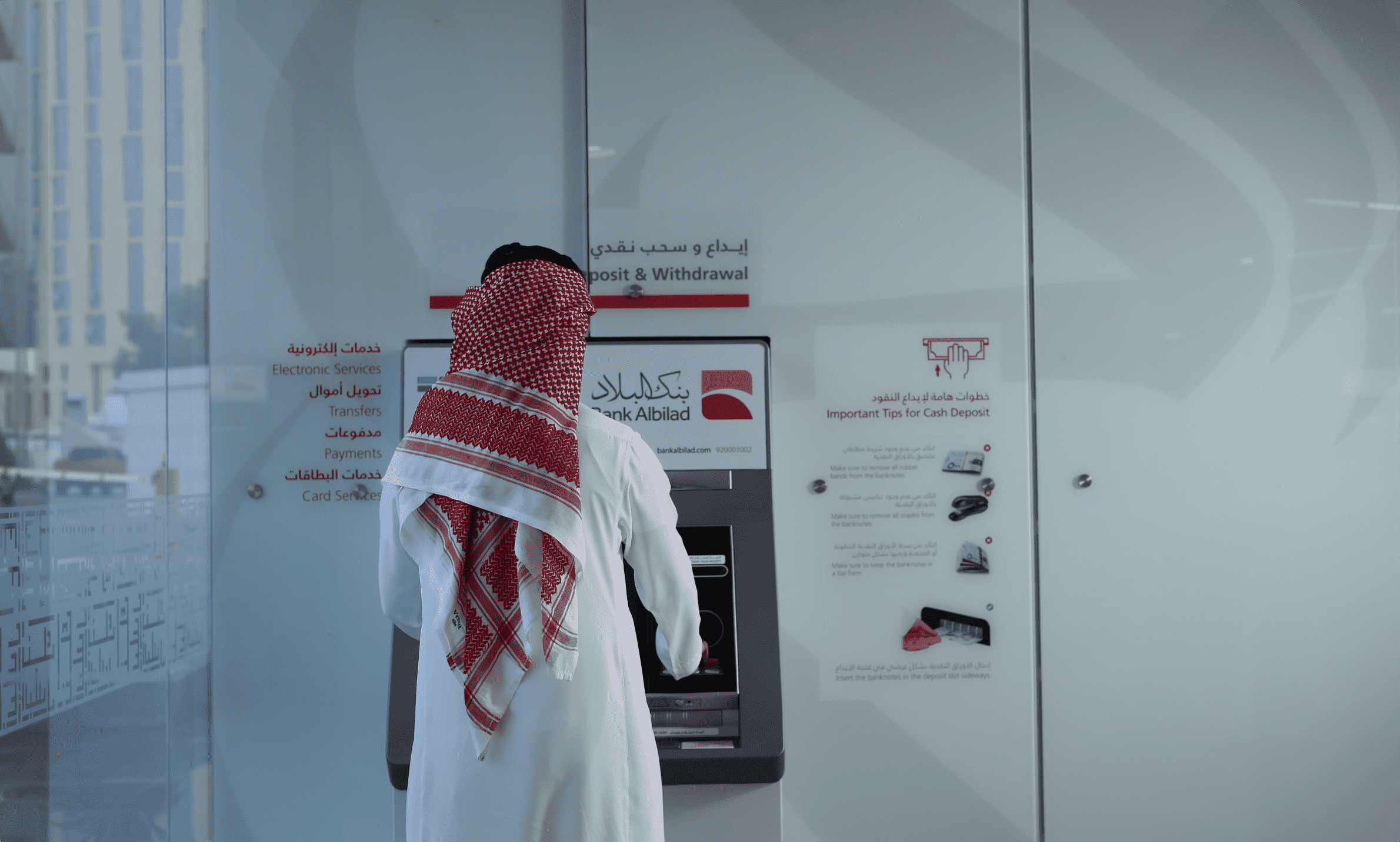

This enables Enjaz to significantly contribute to delivering products and services that contribute to the broader national aims and ambitions set out in Vision 2030. In 2023, Enjaz has increased digital adoption, promoted financial inclusion, and supported the move towards a cashless society - all core pillars of Vision 2030. At the same time, shareholder value has been increased through reduced operational costs and increased transaction margins.

Beyond financial contributions, Enjaz actively engaged in a range of CSR activities in 2023, including environmental initiatives, fraud awareness campaigns, recycling programs, volunteering, afforestation, and Ramadan basket distribution. This reflects the core values of the Bank and its subsidiaries and ensures that our activities deliver more excellent value to the communities in which we operate.

This year, we have also taken steps to improve the customer experience with customer-focused initiatives involving launching a multilanguage call center 24/7, app, and kiosk for an enhanced experience, strict SLAs for customer complaint resolutions, sponsorship of events, marketing campaigns, and participation in national days.