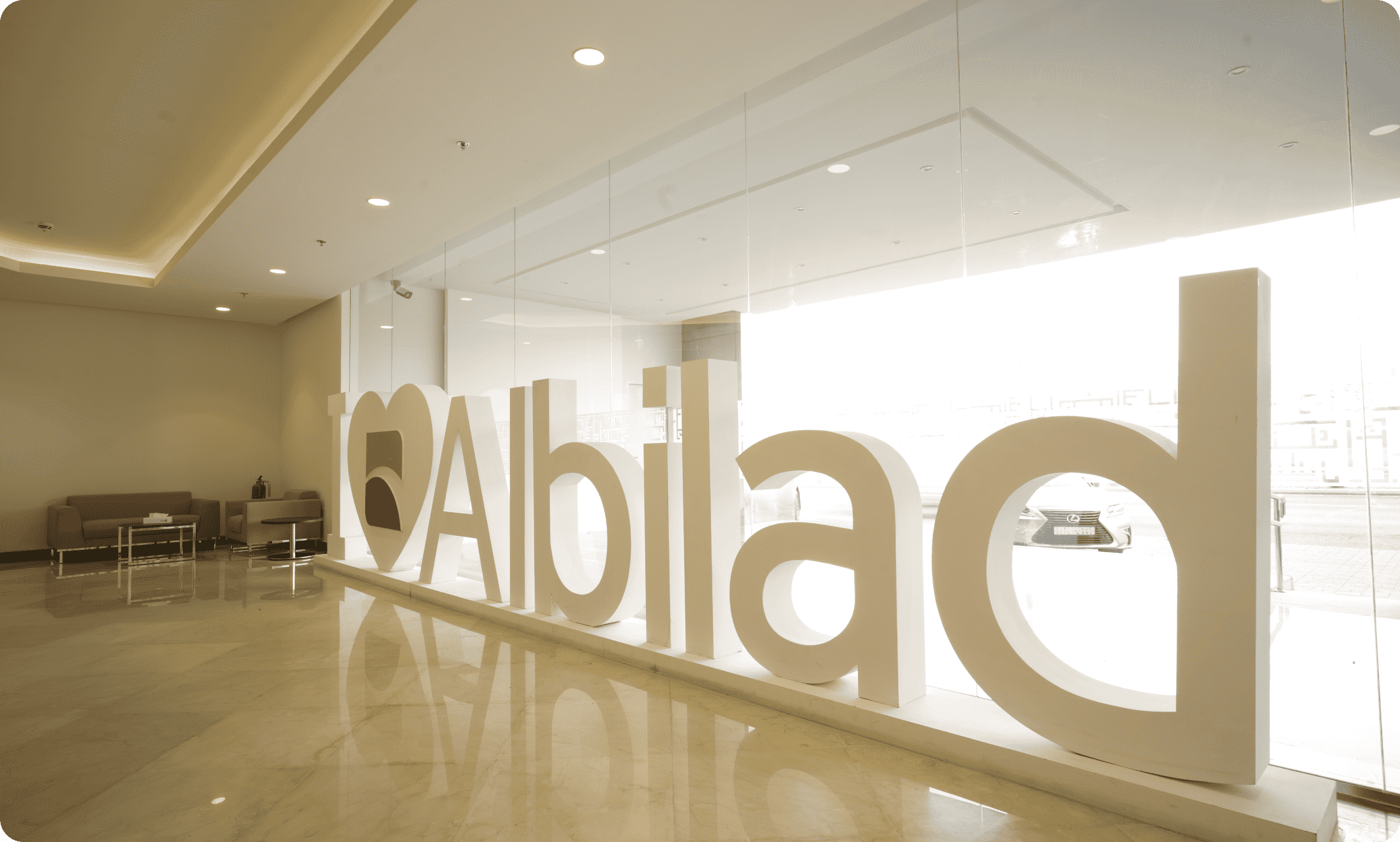

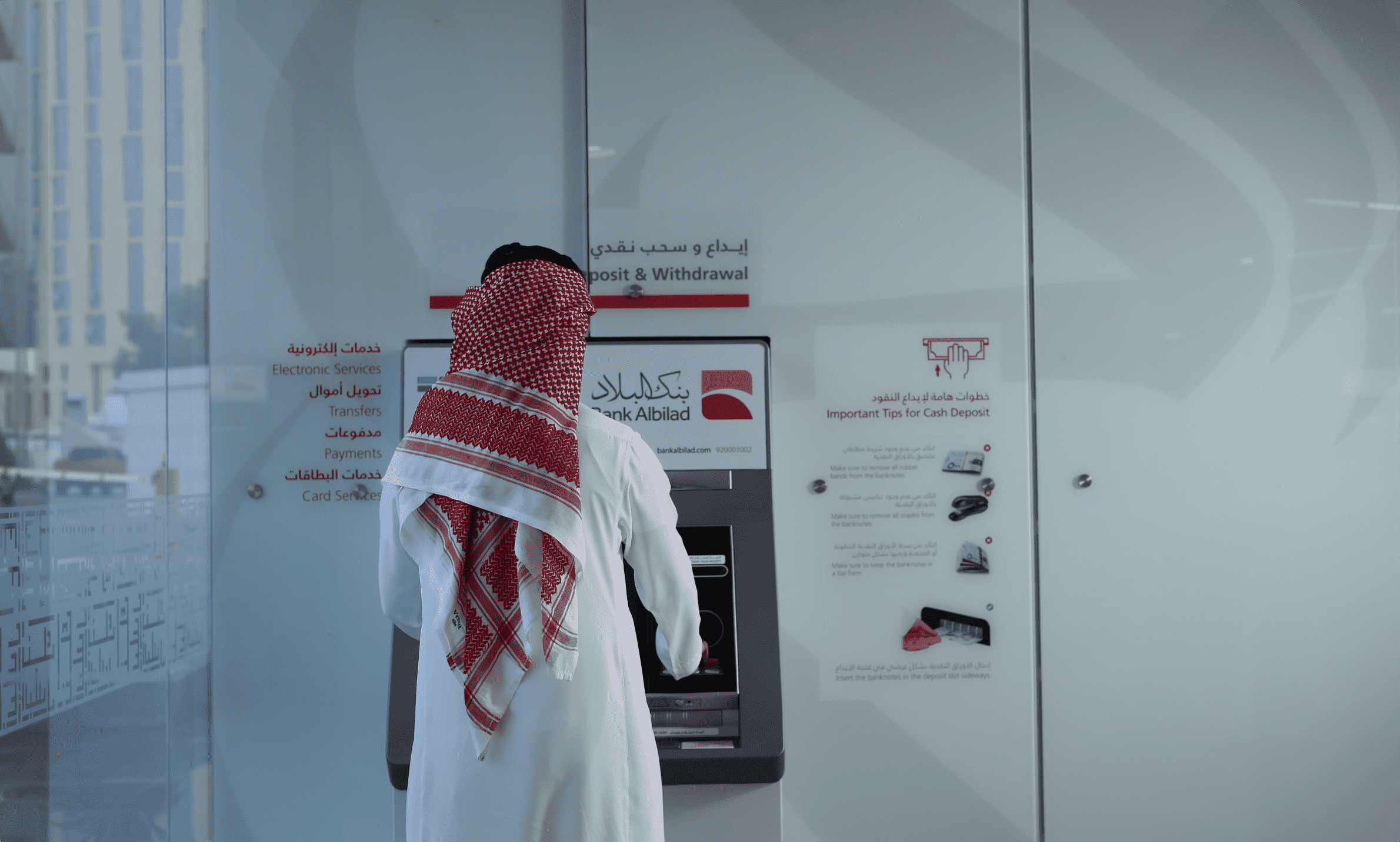

At the heart of Bank Albilad’s approach is embracing innovation to drive efficiency, improve customer experience, and deliver shareholder value. CBG’s participation in the “Open Banking” project, coupled with a clear focus on maximizing the corporate credit portfolio’s volume, demonstrates our commitment to generating optimal returns. In addition, our dedication to improving the credit quality of the portfolio aims to minimize provisions and non-performing loans, thereby maximizing net profit income.

Our efforts not only delivers value to the business, shareholders, and customers. It also brings a range of benefits to Saudi Arabia as a whole. Our work in Corporate Banking aligns with Vision 2030, as evidenced by our consistent expansion policy supporting the MSME sector and contributing to the realization of Vision 2030. The MSME sector is identified in Vision 2030 as critical for driving the economic success of the wider Kingdom. This year, we have worked alongside MSME businesses to develop products and services that fully reflect their requirements.