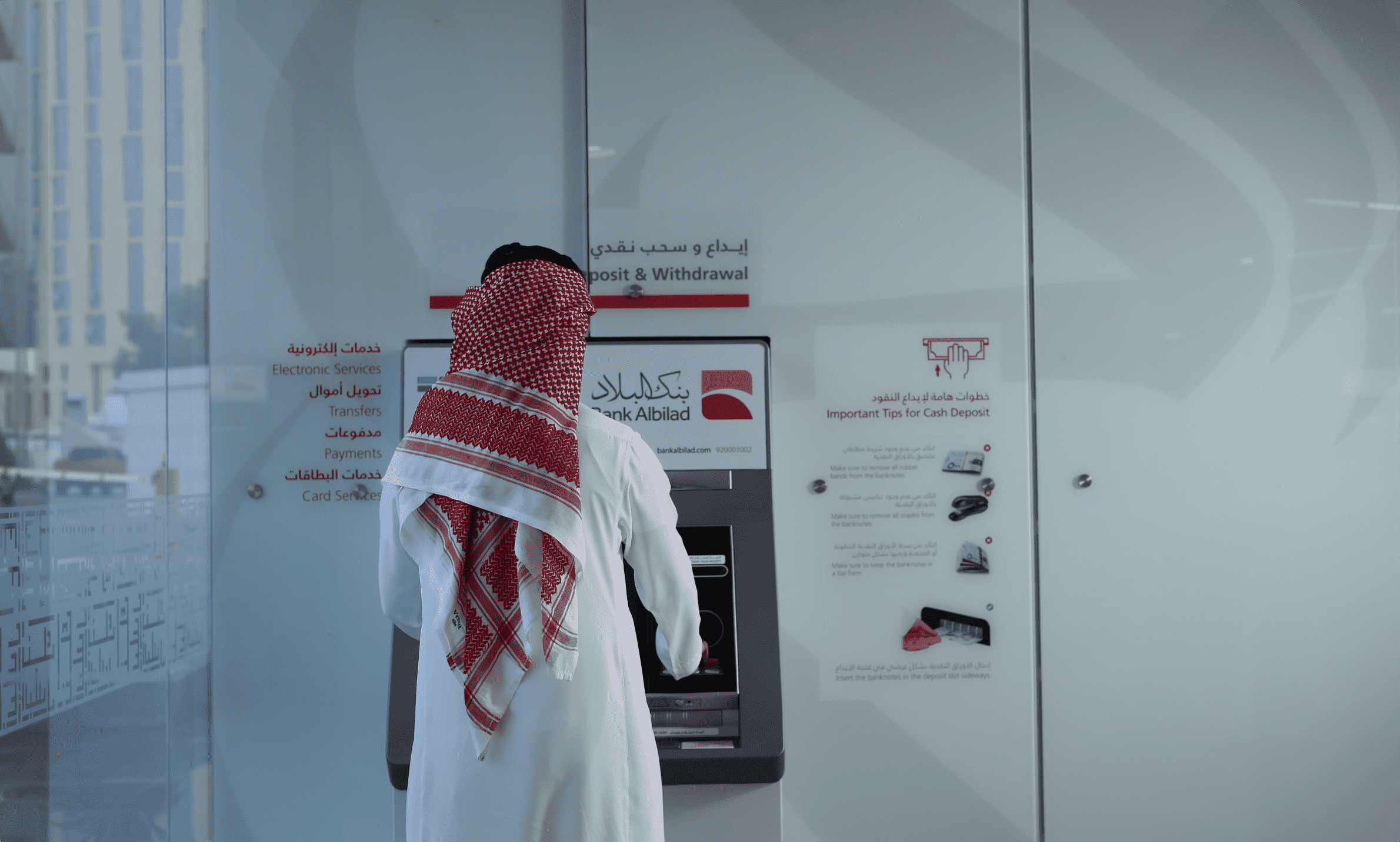

Key achievements include the successful launch of new card products such as Tamkeen plus and Medad Multi-currency prepaid cards, substantial growth in e-commerce transactions and the introduction of groundbreaking services like Investment Wakalah and Business-toBusiness Services that seamlessly integrate our technological solutions through APIs, Introduced Balloon payment Program for mortgages, and launched of Business Return Account which is a savings account intended only for corporate or institutional customers.

We maintain our efforts to create digital experiences that connect face-to-face services with emerging digital solutions. This strategic approach has witnessed an increased reliance on our branch network for providing advice to retail customers, while transactional banking services continue their migration to digital platforms.

Strategic partnerships remain a cornerstone of our approach, contributing not only to our business goals but also aligning with national objectives outlined in the Kingdom’s Vision 2030. To further support the Saudi housing market, the Bank’s partnerships with the Ministry of Municipal & Rural Affairs & Housing and the government’s Real Estate Development Fund (REDF) continued to help widen access to affordable home purchase solutions. Our contributions to home ownership targets through mortgage lending and efforts to encourage savings, are making significant contributions to delivering the wider aims and objectives of Vision 2030.

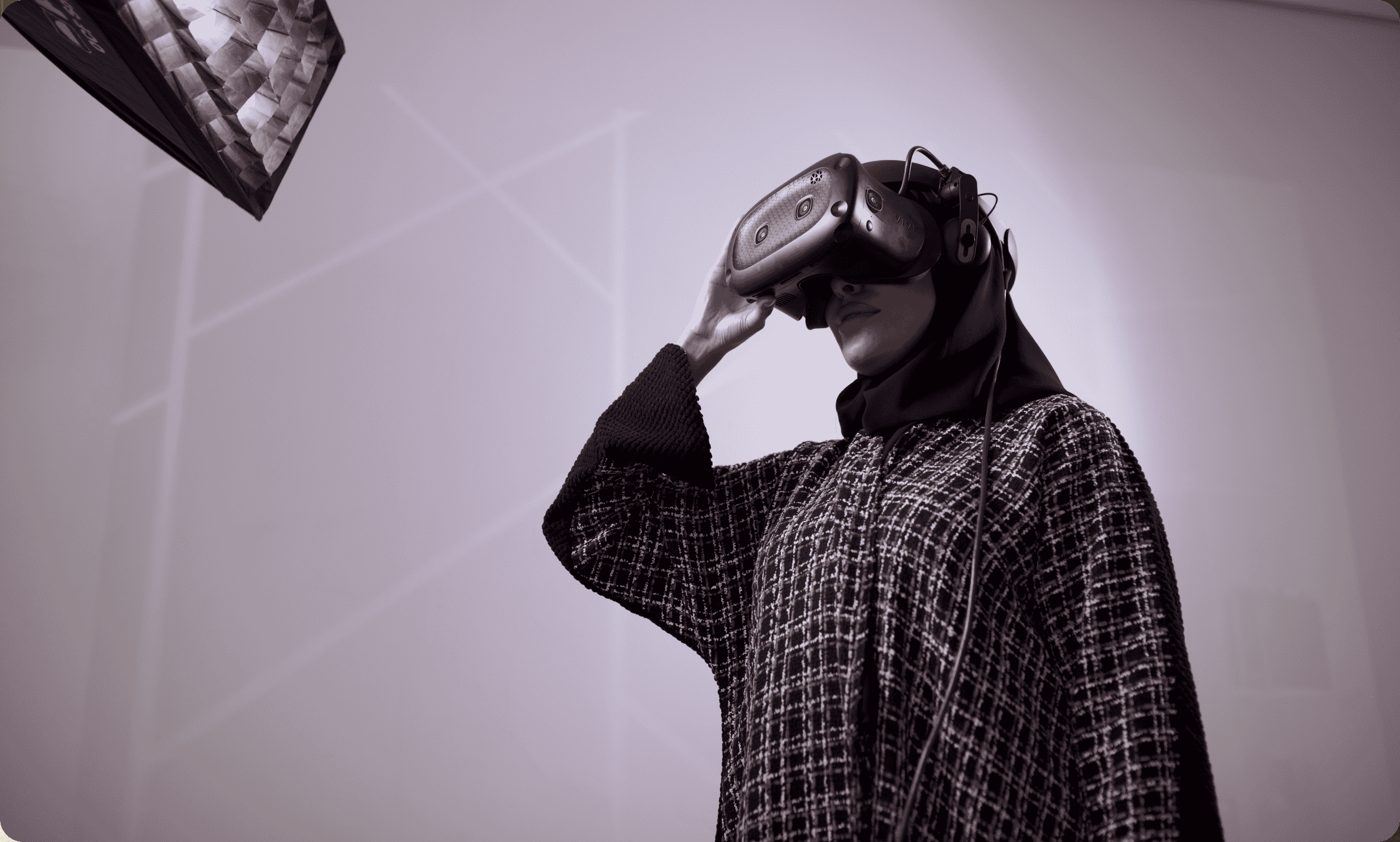

Innovation is a key driving force, as evidenced by the creation of multiple technical demands for developing new services and products in 2023. This focus on innovation has translated into business success, marked by e-commerce growth of over 200%

Financially, our performance in 2023 shows Financing growth of 9%, totalling SAR 50.2 billion, and a substantial 12% year-on-year increase in total retail deposits, reached SAR 62.2 billion by year-end. Alongside these accomplishments, our unwavering focus on understanding and responding to evolving customer needs remains a major driving force.

In 2023, this has included with the opening and renovation of branches to align with Bank Albilad’s new identity, improved customer engagement KPIs, and the implementation of advanced tools like “Speech Analytics” in our Contact Center to enhance service quality.

As we move forward into 2024, Bank Albilad’s Retail Banking Group will continue to leverage innovation to provide Shariah-compliant financial products and services that meet the changing needs of the people of Saudi Arabia.