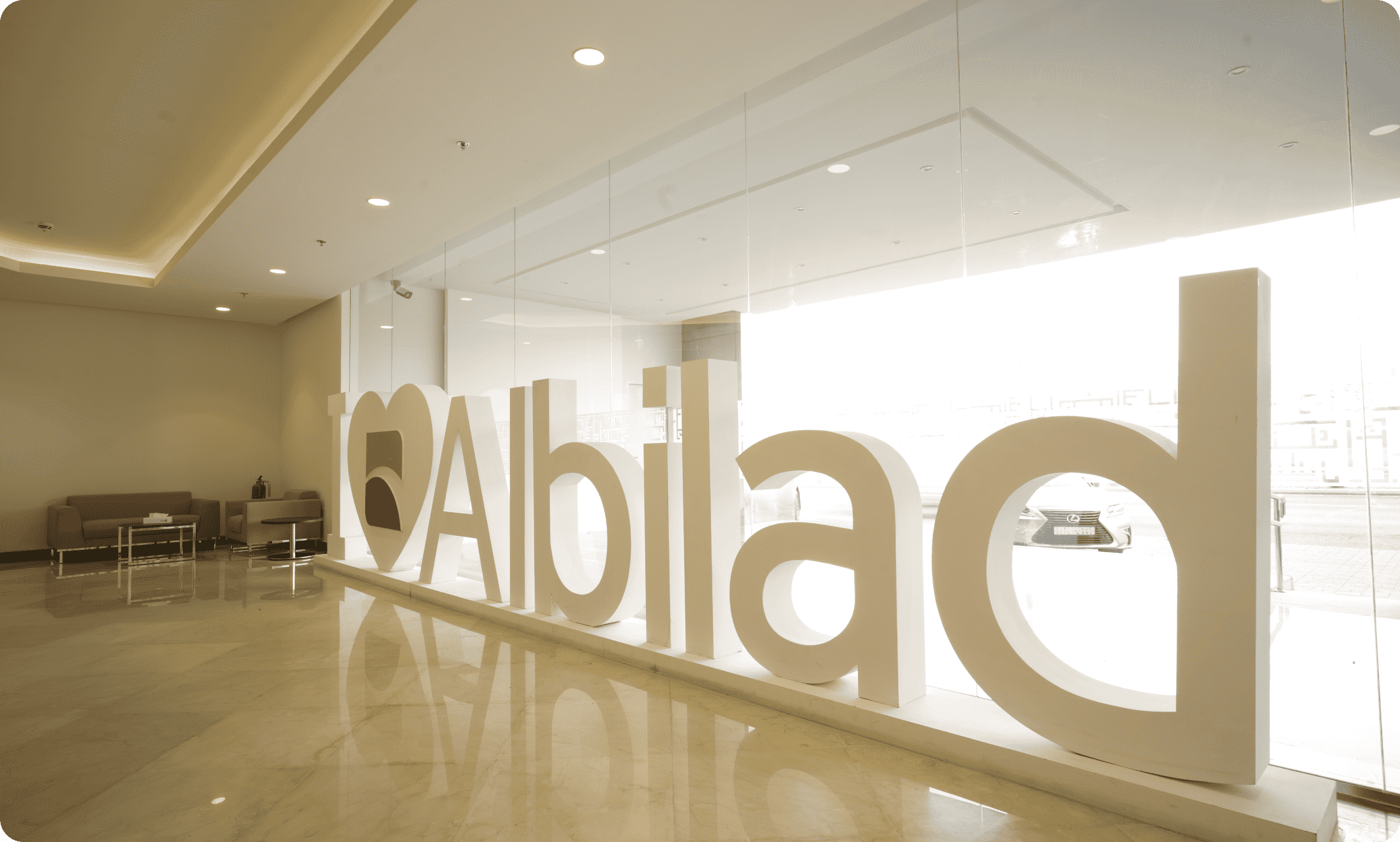

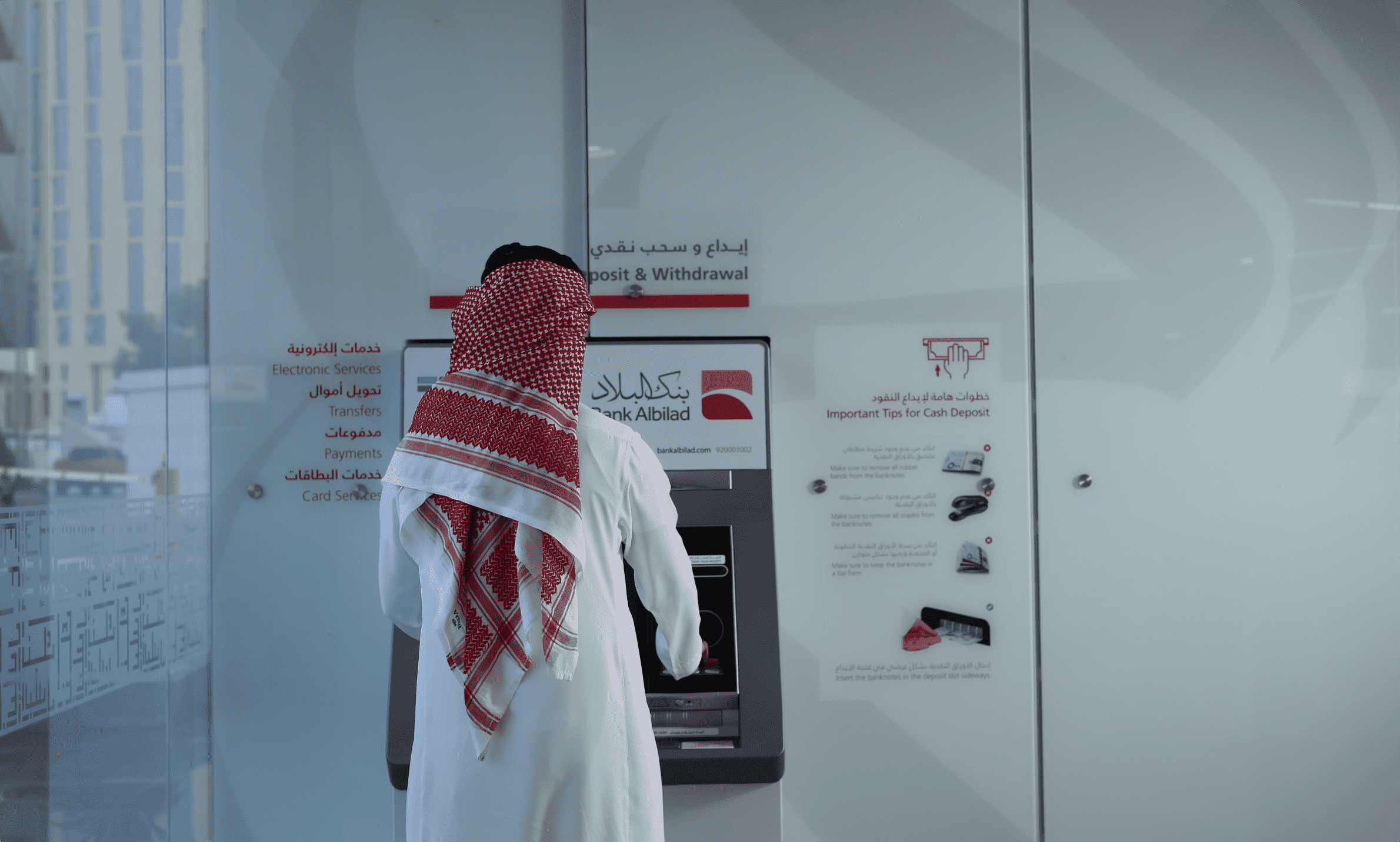

Beyond compliance, our information security measures resonate with corporate social responsibility initiatives. They not only ensure a secure banking environment but also contribute to the ethos of responsible, secure electronic transactions that increasingly provide a bedrock for wider economic activity across the Kingdom.

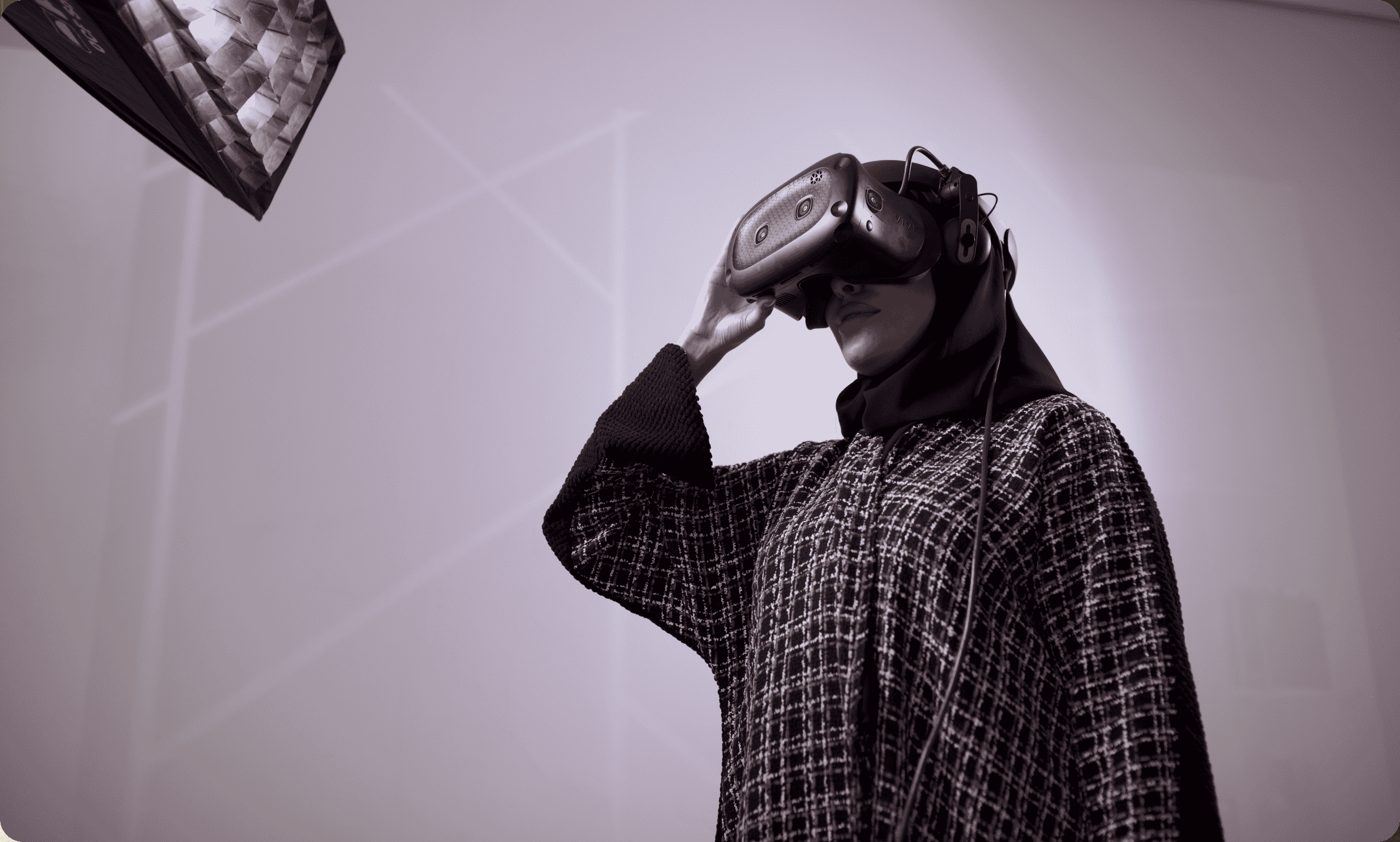

As our digital journey continues, our commitment to security forms an integral thread, securing not just individual transactions but supporting a secure and resilient financial landscape that gives customers, stakeholders, and businesses confidence in the new tools that continue to transform banking in the Kingdom.