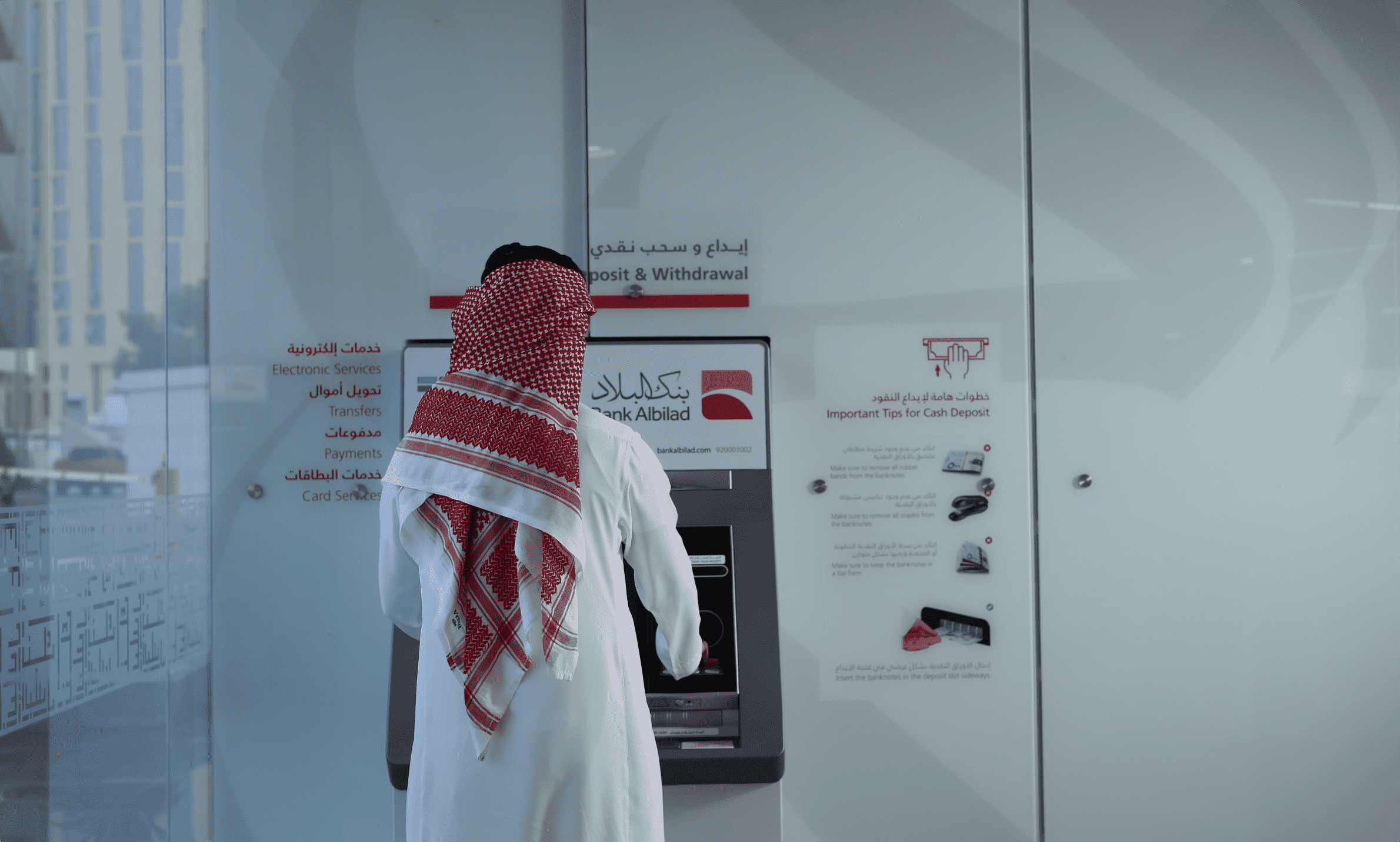

Mobile payments, a key focus for Saudi authorities, have risen to account for 45% of point-of-sale transactions by volume and 35% by value signifying a significant shift in banking preferences.3

This provides a foundation for the continuing work of Bank Albilad to deliver innovation in financial services, meeting the growing needs of the population, particularly younger customers. It also provides a rich ecosystem of new fintech companies with which Bank Albilad will continue to develop collaborative partnerships as we move into 2024.

Real estate and construction sectors continue to thrive, buoyed by mega-projects like NEOM and Qiddiya. By 2030, NEOM alone is expected to contribute over SAR375bn ($100 billion) to the Kingdom’s GDP. Working with government entities and PIF portfolio companies is a central element of Bank Albilad’s strategy.

Efforts to upskill the local workforce are reflected in a fall in total unemployment to 4.8 percent by end-2022 - from 9 percent during Covid. Youth unemployment was halved to 16 percent in 2022 over the past two years while female participation in the labor force reached 36 percent in 2022, exceeding the 30 percent target under Vision 2030. This signals positive advances in job creation and skills development.4

Foreign direct investment (FDI) inflows in 2022 were SAR122bn ($33bn) indicating international confidence in the Saudi market and an increasingly outward-looking mindset across businesses within the Kingdom.5 The Public Investment Fund (PIF) has also become a global force, with assets under management estimated at over SAR2,250bn ($600 billion), diversifying its portfolio across various sectors and regions.