Leveraged across our business verticals

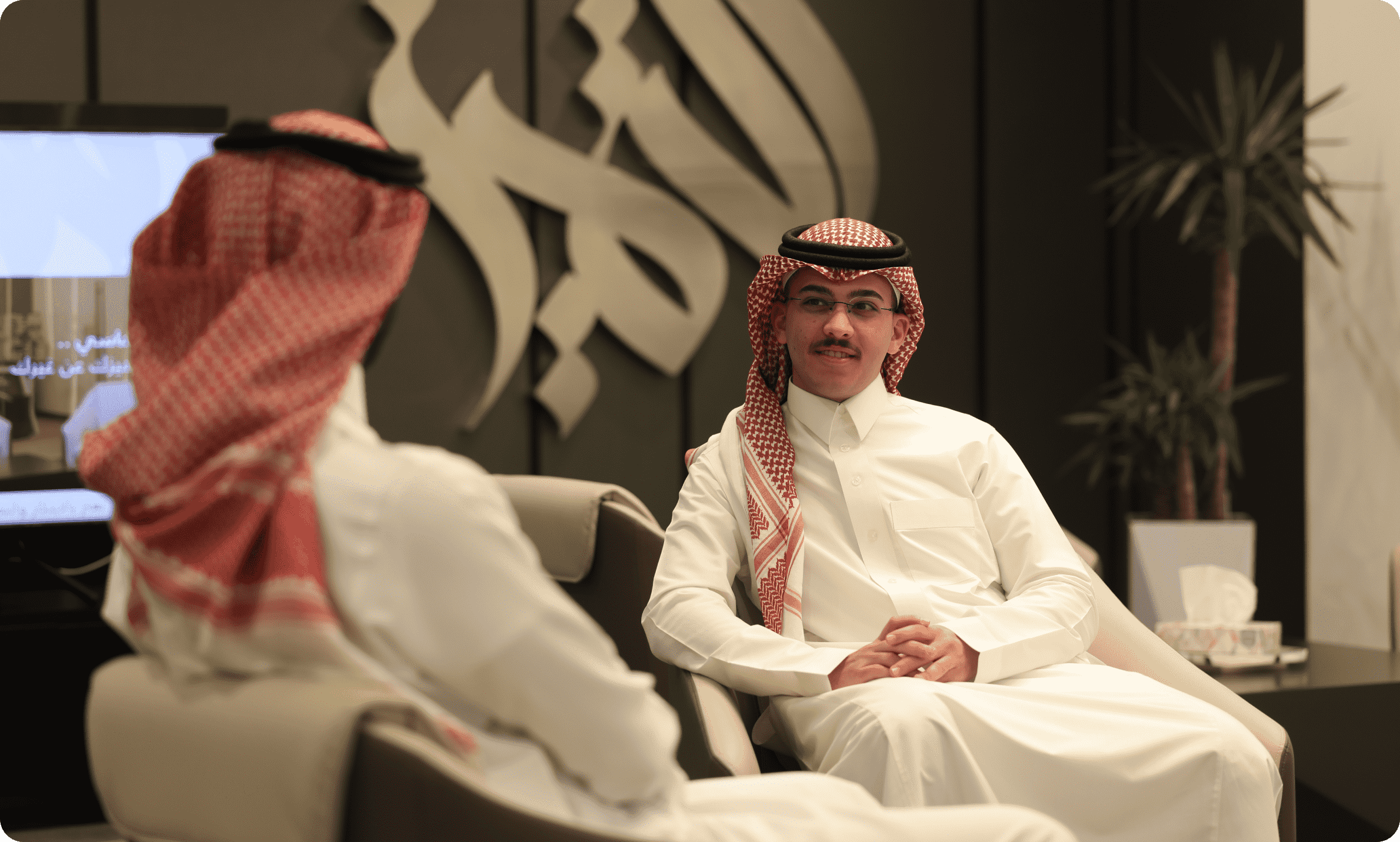

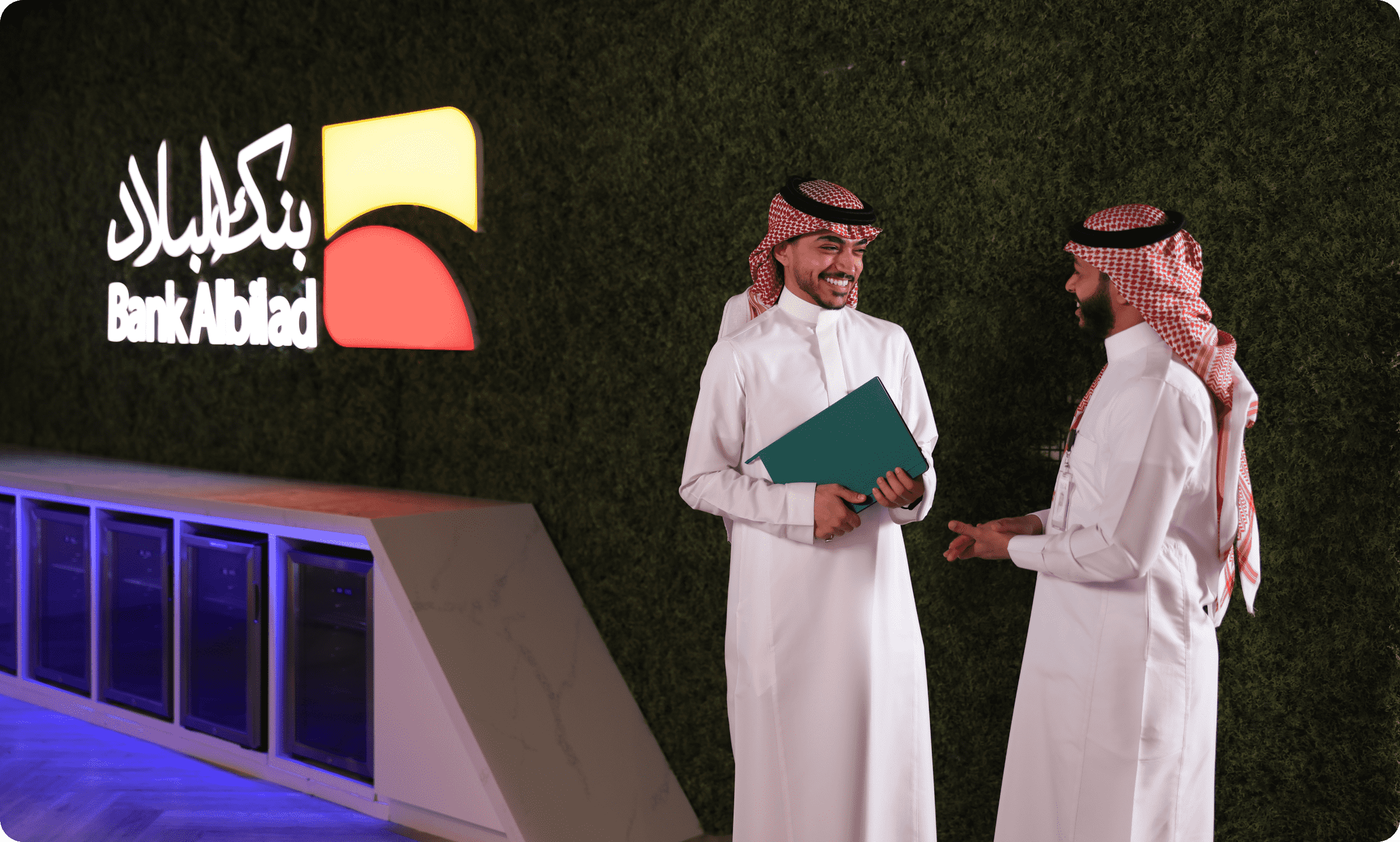

Retail Banking

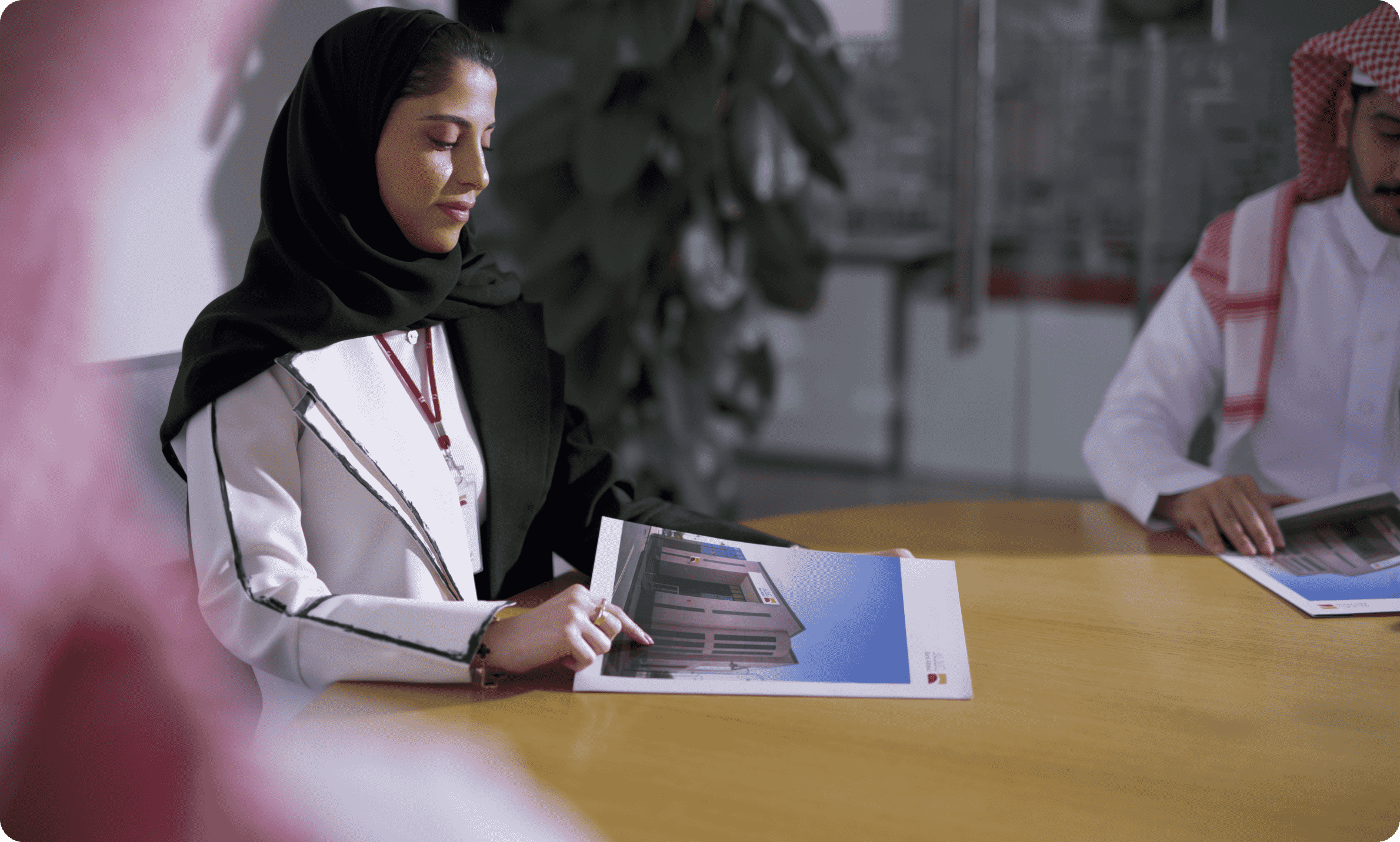

Corporate Banking

Treasury

To facilitate products and services such as

For Our Customers

SMEs

Corporate

Retail

Financial institutions

Through

direct/

indirect channels

Strategic partnerships

Intermediators

Business partners

TO CREATE

VALUE

These values are based on

the foundations of

outstanding risk management,

best governance practices,

and a positive work culture.

our stakeholder

-

Customers

-

Business Partners & Suppliers

-

Investors & Shareholders

-

Regulators & Government Authorities

-

Community

-

Employees