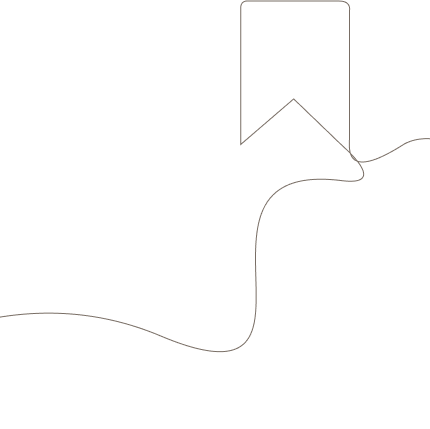

I am pleased to present Bank Albilad’s Annual Report for 2023.

This year’s theme, “Driving Progress Through Innovation”, highlights our firm commitment to deliver value and utilizing cutting-edge technology solutions to meet the changing needs of our customers.

The Bank’s continued strength is reflected in our 2023 results. Bank Albilad delivered solid performance underpinned by sustained growth in loan demand, customer deposits, asset quality and client activities despite the challenging operating environment. Profitability surged on the back of strong loan expansion, higher margins while managing operating expenses.

This year, the Bank has again achieved outstanding performance with all business lines contributing significantly to overall growth. The bank’s Net Income before Zakat increased by 14% to SAR 2,641 Million, compared to SAR 2,321 Million in 2022. Total Assets grew by 10.5% to SAR 143,106 Million, sustained by the expansion in Retail and Corporate financing of 9% and 15%, respectively while Deposits were up by 19%. The bank achieved a return on average assets of 1.74%, while the return on average shareholders’ equity was 16.5%, and earnings per share reached 2.38 riyals per share.

We launched various financial products and initiatives to enhance our customer experience aligned with our strategy to provide innovative Islamic banking solutions in light of evolving customer needs and regulatory requirements. We strengthened our strategic partnership with government, private sector, and fintech entrants in order to meet our customer expectations for better products and services.

We are proud to be the leading partner of (SME Bank) Small and Medium Enterprises Bank (Monsha’at), and Small and Medium Enterprises Financing Guarantee Program (Kafalah) in providing financing solutions to this important sector, in support of the objectives of Financial Sector Development Program (FSDP) to increase the contribution of MSMEs to GDP from 20% to 35% by 2030. We now command a significant market share in this segment.

Bank’s Net Income Before Zakat

for the current year grew by

0%

reached

SAR0,0MN

In line with these partnerships and to achieve the Vision 2030 goals related to the housing sector to facilitate for our citizens to buy homes, we introduced several and innovative housing products.

Our investments in our IT capabilities have allowed us to transition into a modern architecture platform with improved speed, reliability, and flexibility. These IT innovations have resulted in better and faster service for our clients and in better processes for our staff.

and launched a new Fraud Management System with AI capabilities protecting businesses and customers from the rapidly emerging new threats from increased digitalization. We also implemented a new Treasury Management System and Enterprise Content Management and Archiving System. Similarly, in 2023, Bank Albilad was the first Saudi Bank to enable the Open Banking Services in accordance with the regulatory framework issued by SAMA reflecting our pioneering and full support towards the Financial Sector Development Program (FSDP) under Saudi Vision 2030. This major milestone will allow us to integrate new models and opens Bank Albilad to new partners by facilitating frictionless integration. With a rapidly expanding Saudi Arabian FinTech sector, this will create new opportunities to expand our market position and secure further growth.

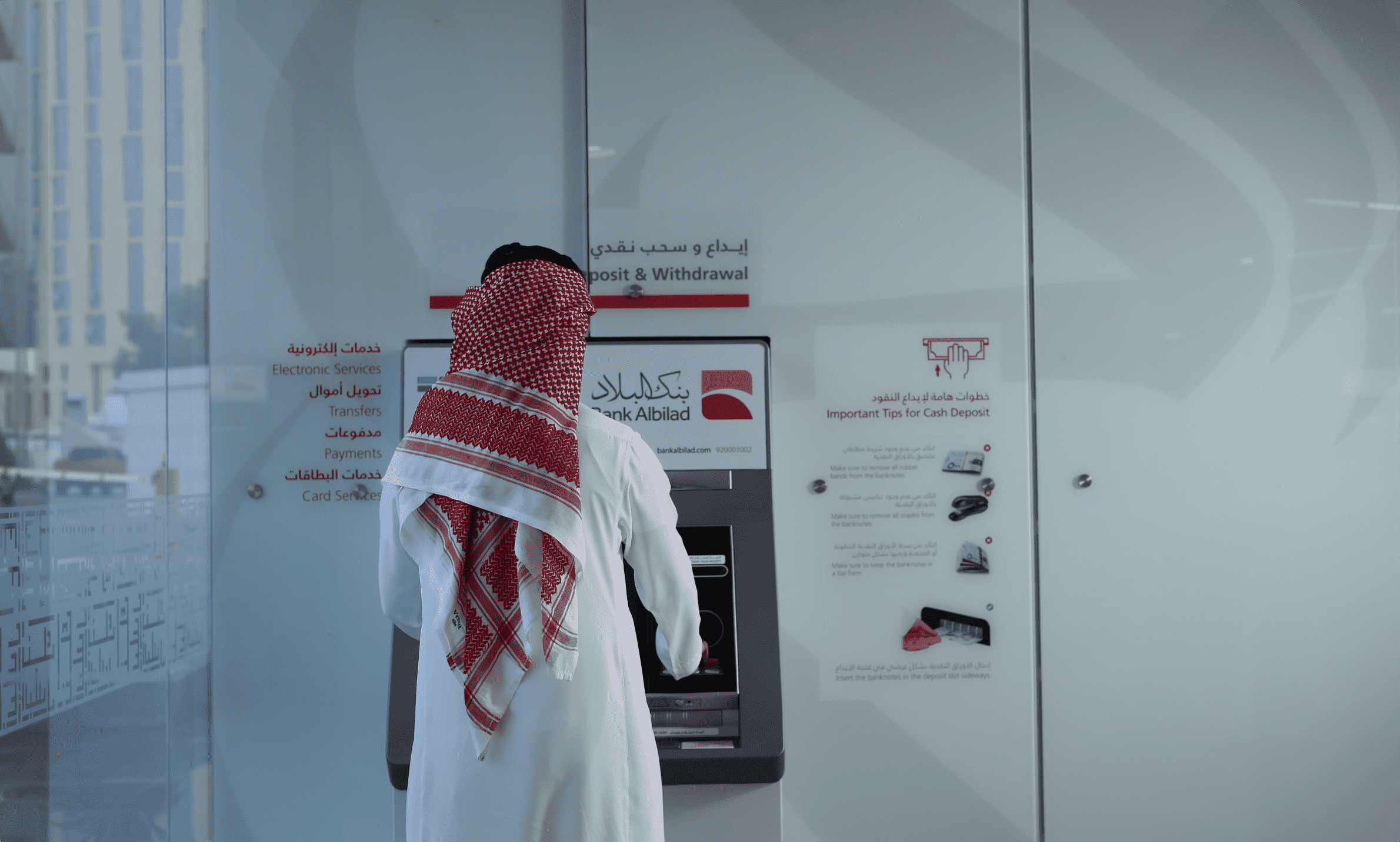

Complementing these is the launched of Bank Albilad’s New Generation Model Branches. These are smart branches built to highest standards and equip with the latest technologies that contribute to preserving the environment while providing an enriching customer experience.

ESG principles are central to our operations, and we are working closely with important stakeholders to strengthen guidelines to ensure activities deliver on wider social and environmental goals.

Bank Albilad is proud to have provided the necessary support for the Second Conference on Food Security and Environmental Sustainability under the auspices of King Faisal University. This event was a valuable opportunity to enhance awareness and stimulate cooperation and partnerships between the public, private and academic sectors to achieve and build a sustainable future for our citizens. The bank also participated as a strategic partner in the Third Riyadh International Humanitarian Forum organized by the King Salman Humanitarian Aid and Relief Center. In addition, Bank Albilad sponsored various other forums aimed at spreading savings and investment awareness.

I express my sincerest gratitude to the Custodian of the Two Holy Mosques and the Crown Prince – may Allah protect them – and the Ministry of Finance, the Saudi Central Bank (SAMA), the Ministry of Commerce, and the Capital Market Authority, for their continued support in ensuring a robust and stable banking sector and economy.

Our accomplishments were made possible because of the enduring trust and support of the Bank’s various stakeholders. I am grateful to

Financial Sector Development Program (FSDP) to increase the contribution of MSMEs to GDP from

our customers, partners, and shareholders for their untiring support to the Bank throughout the year. I would like to thank our Board of Directors, for their guidance, encouragement, and support to continue driving progress through innovation.

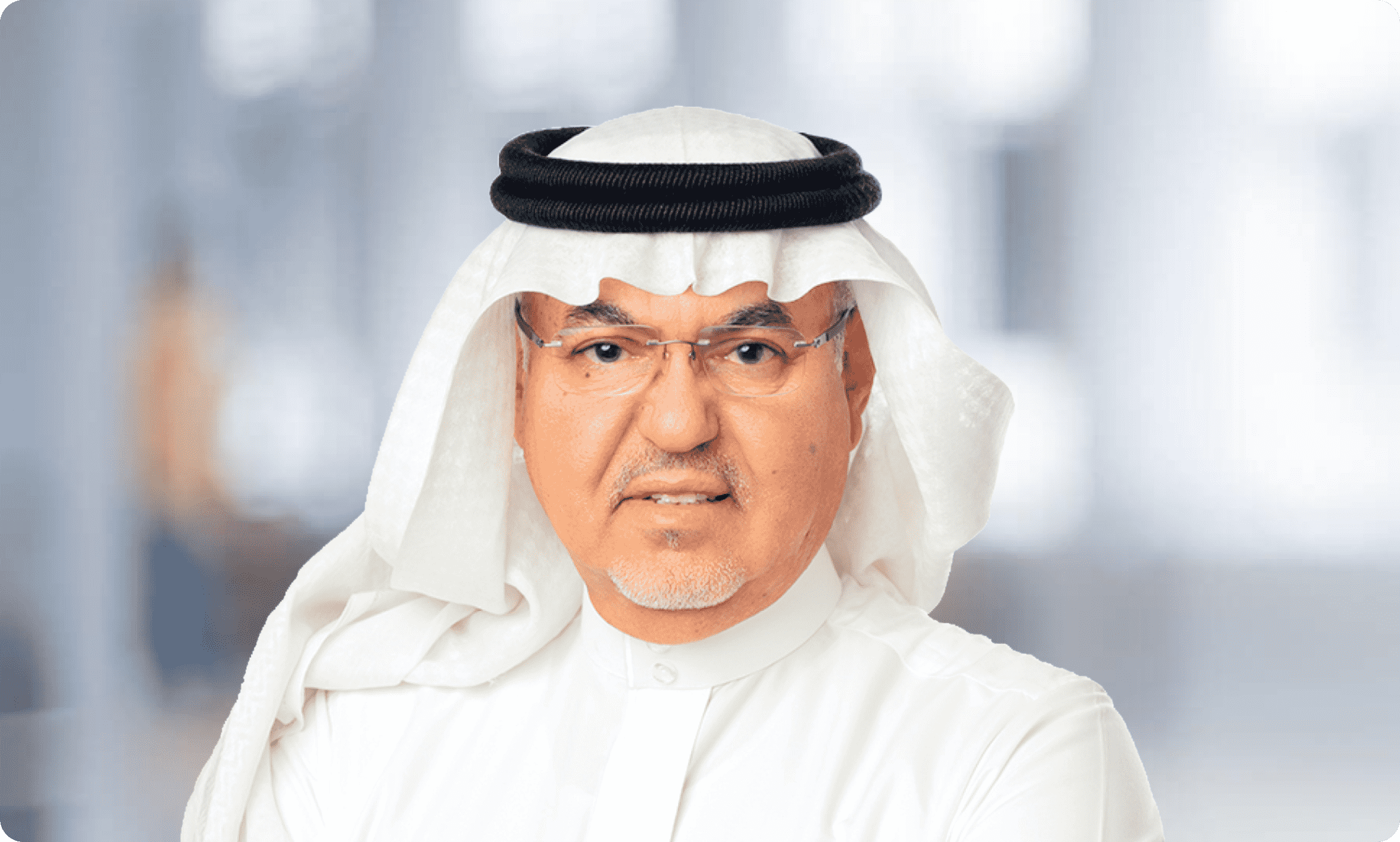

Abdulaziz M. Al-Onaizan

Chief Executive Officer

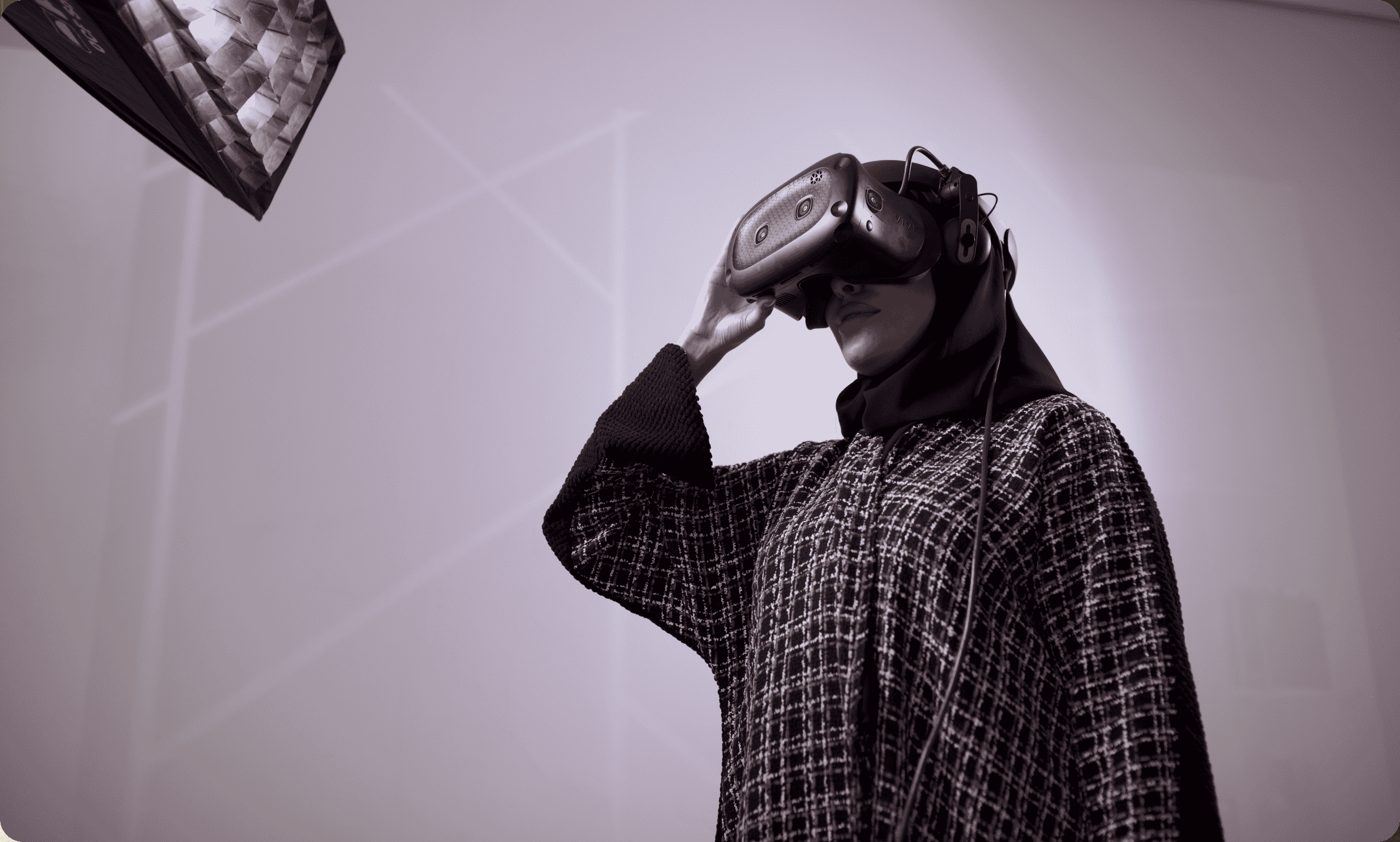

A TRANSFORMATIVE YEAR for the Bank’s technology journey

We are aware that to remain at the forefront of product innovation, we must continue to invest in our systems and processes.

Our investments

in our IT capabilities have allowed us to transition into a modern architecture platform with improved speed, reliability, and flexibility.

These IT

innovations have resulted in better and faster service for our clients and in better processes for our staff.

ADVANCE FINANCING INCLUSION

Over the past year, we have continuously and firmly supported the key initiatives to facilitate the access to financial products and services for all sectors of society,

the engine that

can drive the wider transformation. Supporting our citizens to build savings, buy homes, or channeling to small businesses the funding and knowledge they need to grow, can help shape a prosperous and economically diverse future for Saudi Arabia.