We actively promote savings

through competitive products

like Wakalah and savings

accounts, aligning with the

overarching national vision.

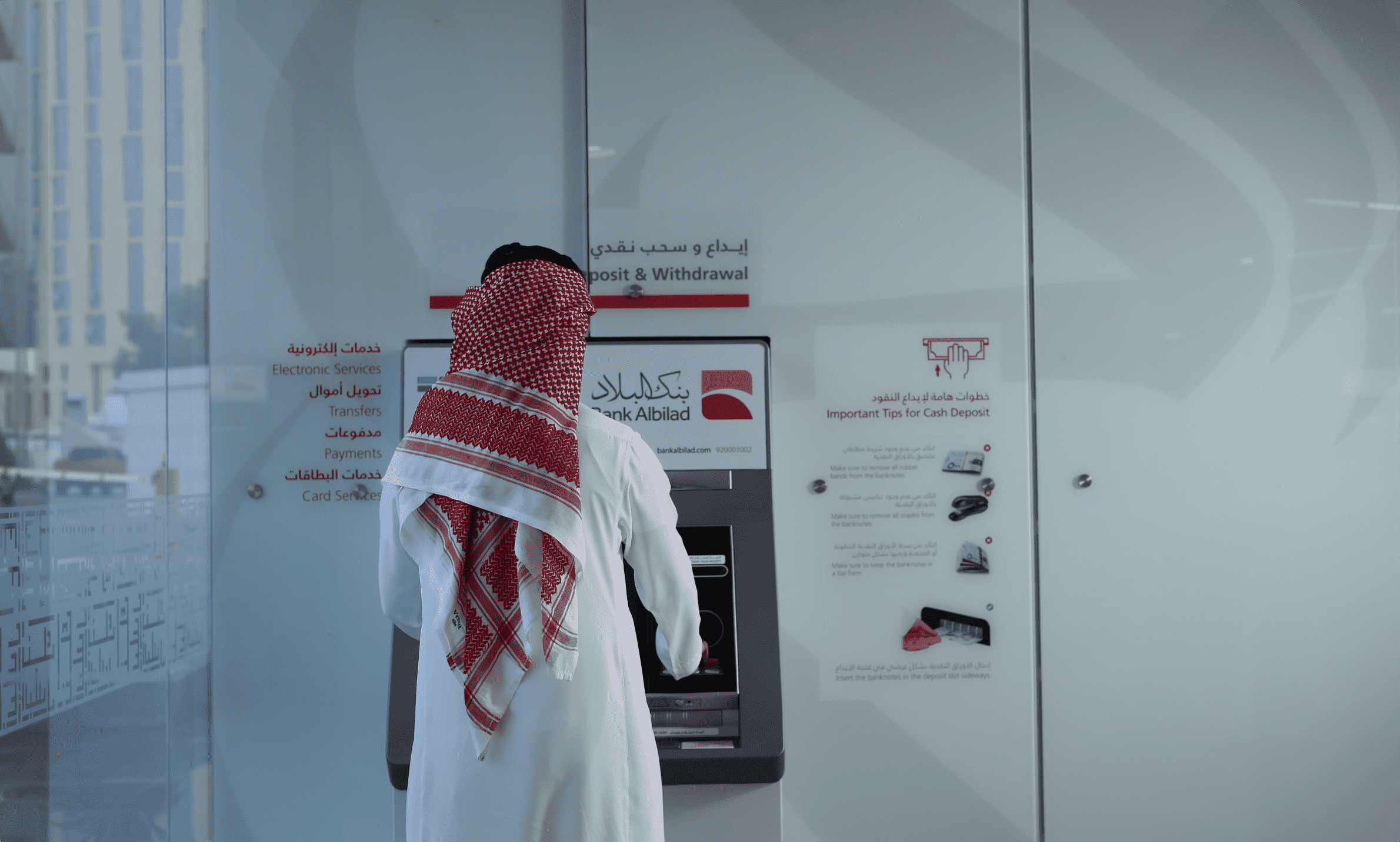

During this year, several critical milestones and achievements are testament to Bank Albilad’s commitment to innovation. In 2023, we have overseen the introduction of new card products like Tamkeen Plus and multi-currency cards, the successful launch of Wakalah products through all channels, the offering of diverse real estate products, and the completion of Core Banking Modernization.

Additionally, we implemented a robust Antifraud System, extended our work in Open Banking & BaaS (Banking as a Service) products, and enhanced connectivity with SD-WAN for offsite ATMs using 4G sim cards. Major upgrades for storage, databases, operating systems, and applications, along with the migration of development and SIT environments to the cloud, showcase our commitment to enabling a robust foundation that supports business resilience and maintains services for customers.

As part of the Bank’s contribution to Vision 2030, our IT initiatives play a pivotal role in supporting flexible real estate products and contributing to homeownership for citizens. We actively promote savings through competitive products like Wakalah and savings accounts, aligning with the overarching national vision.

We also enable the Bank to deliver on a wider range of social, environmental, and economic activities through an engrained commitment to Corporate Social Responsibility (CSR) initiatives. The implementation of the Waed program, participation in the Zood Saving Programs from the Social Development Bank, and our role in developing small and medium-sized enterprises (SMEs) through SME Bank Program loans underscore our commitment to projects that benefit communities throughout Saudi Arabia.

400

initiatives in Retail, Operations, Corporate,

IT, Capital, Enjaz, and Treasury