CEO’s Statement

Since our foundation in 2004, Bank Albilad has firmly established itself as one of the key players in the Saudi Arabian financial sector. Guided by the insight and wisdom of our board, we delivered value to all stakeholders. We see our role in delivering modern Islamic banking an important driver of the Kingdom’s economy.

This is true whether we are supporting home ownership, providing SMEs with necessary financing support, or enabling corporates to expand and contribute to the Kingdom’s progress.

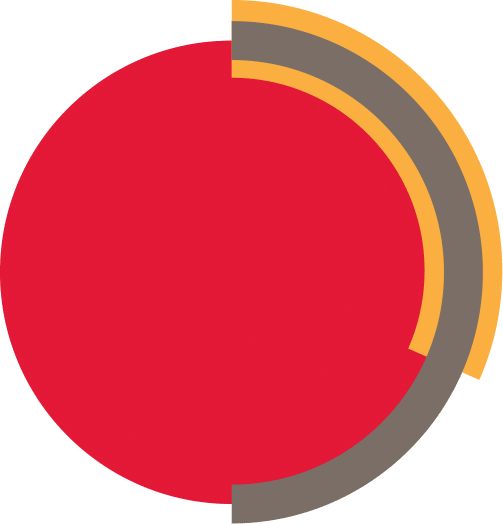

This year, the Bank has achieved several milestones driven by record income. All business lines performed very well across the board. The Bank’s Net Income for the current year grew by 23% to SAR 2.1 Billion, compared to SAR 1.7 Billion in 2021. This is mainly due to the growth of the Bank’s Total Operating Income, which increased by 13% to SAR 5.2 Billion. Total Assets grew by 17% to SAR 129.5 Billion, sustained by the growth in Retail and Corporate financing of 12% and 8%, respectively while Deposits were up by 17%. The bank achieved a return on average assets of about 1.7%, while the return on average shareholders’ equity was 16.4%, and earnings per share reached to 2.09 riyals per share.

23

%This growth has been delivered through strong leadership at board level and the talent, dedication and commitment of our ambassadors.

INNOVATING FOR A DYNAMIC BUSINESS

At the heart of our growth is innovation. We introduced new as well as enhanced existing products and services, pivoted to new processes, leverage current technologies, and aligned the right people to the right roles which sustained our performance and delivered efficiency in our core operations. Innovation will remain a core element of our future growth strategy, driving us forward to even greater achievements.

In line with the continuous efforts and ongoing strategy towards growth and expansion in innovative digital services, and in alignment with the Financial Sector Development Program of the Kingdom’s Vision 2030, as well as working to develop payments and financial technology services, we have incorporated Enjaz Payment Services Company as a subsidiary owned by the bank aiming to transform Enjaz to a new era in which it contributes to Saudi Arabia’s transition towards a cashless society. This strategic move comes as a part of the bank’s efforts to enhance its competitive ability in digital payments services which will contribute to further enriching the customer experience and enhancing financial inclusion to support and develop the national economy.

This year witnessed another important milestone in our innovation journey, with the launch of the Bank’s new Horizons Innovation Centre. This new centre will promote cooperation with fintech companies and innovation partners. In time, this will lead to the incubation of new innovative financial services in support of the Financial Sector Development Program under Vision 2030. The Bank also took the initiative to host the Joint Operations Center to Combat Financial Fraud. The center brings together all Saudi banks under one roof that will monitor and address all cases of financial fraud that bank customers may be exposed to thereby improving customer experience.

The Open Banking Framework recently introduced by SAMA will create significant impact in the financial industry. Therefore, it was an opportune time for Bank Albilad to have signed a memorandum of understanding with Saudi Payments and technical agreements with other innovation partners to support to the introduction of new, innovative products and services.

PARTNERSHIP FOR growth

Partnerships helped our business thrive, acquire new client base, and create new revenue streams.

We recently signed a joint financing agreement with the Small and Enterprise (SME) Bank. Providing facilities to this important sector will support the objectives of Financial Sector Development Program (FSDP) to increase the contribution of MSMEs to GDP from 20% to 35% by 2030. We also entered into agreement with the Saudi Export-Import Bank aimed at promoting the development of Saudi non-oil exports. We maintain an excellent partnership with the Ministry of Housing and Real Estate Development Fund (REDF), within the framework of the Tatweer Program which increased the size of our mortgage business. Our partnerships with Mobily Pay, Thunes and Union Pay will make us an even stronger player in the highly competitive mobile payment, remittance, and fintech space.

EMPOWERING EMPLOYEES

Speaking about our Ambassadors, our strength is our people. Therefore, we will continue attracting the best qualified personnel, which represents the real capital of the Bank. We focused on identifying new ways to upskill, support and reward staff, and to ensure that they continue to play pivotal role in delivering value for the Bank.

Training to improve skills and competencies at all levels are being facilitated through our advanced Albilad Academy Portal and outsource training. On talent development, we rolled out the Advanced Ambassador Program to develop the most talented, high performing staff and facilitate their career progression into senior positions in the Bank. We also have the Albilad Future program that recruits bright young talents and prepares them to become future officers. 2022 saw the enrolment of two batches composed of 53 trainees from diverse backgrounds.

Working together in implementing sound governance, strengthening processes and controls, ensuring security and safety.

COMMUNITIES, ACTING ON THE ENVIRONMENT

Each year, the Bank supports local communities through a variety of Corporate Social Responsibility (CSR) initiatives through Corporate Social Responsibility Program #Albilad_Mubadarah.

In 2022, Bank Albilad’s social responsibility initiatives and programs have exceeded more than 70. We also made sizeable donations through the Ihsan platform for charitable causes. We introduced various ways to incorporate more power-efficient materials in some of our branches, which included LED lighting and solar panel solutions, as well as reducing the energy consumed by the Bank’s ATMs and increasing the amount of waste recycled annually.

Finally, I express my sincerest gratitude to the Custodian of the Two Holy Mosques and the Crown Prince – may Allah protect them – and the Ministry of Finance, the Saudi Central Bank (SAMA), the Ministry of Commerce, and the Capital Market Authority, for their continued support in ensuring a robust and stable banking sector and economy.

I am grateful to our customers, partners, and shareholders for their untiring support to the Bank throughout the year. I would like to thank our Board of Directors, for their guidance, encouragement, and support as we set out to meet our strategic objectives in 2022 and continue building a solid foundation for the future.

In closing, our Ambassadors, thank you for your significant contribution that helped us successfully reach an excellent position in the market today.