Financial & operational highlights

Total equity

- 2019 - SAR 0m

- 2018 - SAR 0m

Net profit attributable before Zakat

- 2019 - SAR 0m

- 2018 - SAR 0m

ROA% After Zakat

- 2019 - 0%

- 2018 - 0%

Net Finance

- 2019 - SAR 0m

- 2018 - SAR 0m

EPS

- 2019 - SAR 0

- 2018 - SAR 0

Customer deposits

- 2019 - SAR 0m

- 2018 - SAR 0m

0

Training hours0%

Increase in customer registration on online channels0%

Saudization0%

Increase in Mobile Banking transactions volume0+

Ambassadors0

Enjaaz Centers0

Branches in the KingdomMEFTECH

FINNOVEX AWARDS

About Us

Bank Albilad is a Saudi joint stock company, established by Royal Decree in 1425H (corresponding to 2004) with a corporate capital of SAR 3,000,000,000.It is the 11th bank in the Kingdom headquartered in Riyadh, Kingdom of Saudi Arabia, and listed (ALBILAD) on Tadawul, the Saudi Stock Exchange. The Bank operates over 110 branches across the Kingdom of Saudi Arabia, with 33 sections for women as well 5 sales centres and over 179 Enjaz remittance centres. The Bank provides Shari’a compliant services to personal, corporate and SME clients, supporting the latter through specialized centers in a number of cities throughout the Kingdom.

Vision

To be the choice provider of genuine Islamic banking solutions

Mission

To strive through initiatives and innovations to provide our banking services on a genuine Islamic bases to meet the ambitions of our stakeholders: clients, employees and shareholders.

Values

- Initiative and Innovation

- Care and Partnership

- Trust and Accountability

Abdulrahman bin Ibrahim Al-Humaid

Chairman

Chairman’s statement

A core focus for us in 2019 – and one that defines Bank Albilad’s strategy for the future – was the extensive introduction of digital technology across our personal banking franchise, as well as the business as a whole.

Read More Download PDF

Abdulaziz Mohammed AlOnaizan

Chief Executive officer

CEO's statement

The Bank provided high quality services to its customers, enhanced operational efficiency, and supported human resources development within an attractive and stimulating work environment.

Read More Download PDFChairman’s statement

Abdulrahman bin Ibrahim Al-Humaid

Chairman

A core focus for us in 2019 was the extensive introduction of digital technology across our personal banking franchise, as well as the business as a whole.

All praise due to Allah, and peace and blessing be upon the Prophet of Allah, his family and all of his companions.

On behalf of the Board of Directors, I am pleased to present Bank Albilad’s Annual Report for the fiscal year ended 31 December 2019. As the financial statements and business narratives in this report demonstrate, Bank Albilad again produced a strong annual performance. Revenues amounted to SAR 3,945 million, an increase of 15% over the previous year, with net profits before Zakat of SAR 1,387 million, a 25% increase since 2018.

The demand for digital delivery of financial services in Saudi Arabia is growing rapidly. Customers expect us and our national counterparts to match the capabilities of banks in highly advanced economies. Thus, a core focus for us in 2019 was the extensive introduction of digital technology across our personal banking franchise, as well as the business as a whole. The banking industry worldwide is being challenged and disrupted by new providers who can deliver seamless, efficient and convenient financial services, particularly to retail customers. It is therefore imperative that we stay ahead of this trend if we are to defend and grow our business. We invested heavily in this area of our operations, opened a number of new branches and other outlets and improved our branches network to give those customers seeking personal services the choice they continue to appreciate from us.

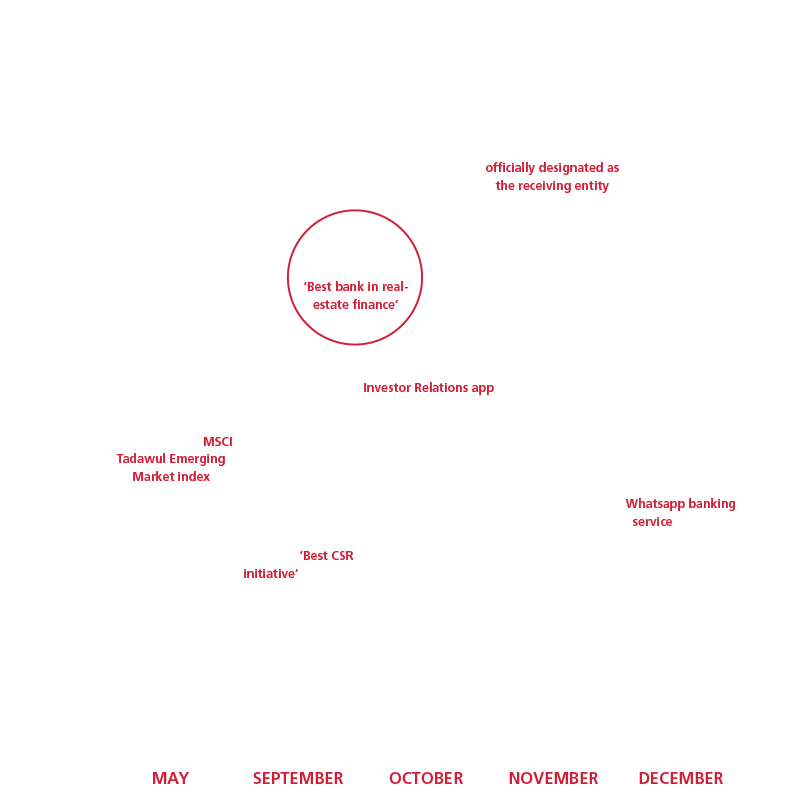

More broadly, it is generally recognized that the economic outlook for Saudi Arabia in the medium term is positive. Measures are being taken by the Government to open up the economy to foreign investment and allow all residents greater participation across a wide spectrum of activities and social interaction. The second and final phase of Saudi Arabia’s inclusion in the MSCI Emerging Markets Index highlights the willingness of the Kingdom to welcome international investors; a phase which, in 2019, saw the inclusion of Bank Albilad and that gives Tadawul a weight of 2.8% on the MSCI Index.

The Kingdom's leadership G-20 in 2020 is a strong evidence and the world is increasingly recognizing that Saudi Arabia has much to offer as a partner in trade, investment and co-operation across many spheres. All of this bodes well for the future prosperity and wellbeing of the country and its people – and for the achievement of the Saudi Vision 2030.

As the economy responds to the significant stimulus from the Government, we look forward to achieving further growth in our corporate business, which represents almost half of our balance sheet.

Despite the bank being one of the smaller Saudi national banks, we have demonstrated our dynamism and confidence through expanding our geographic presence and range of services.

The overall theme of Bank Albilad’s strategy for 2020 is grounded in leveraging our channels, our network and expertise among our own people to support sustainable growth and boost our revenue streams. As our international ratings also demonstrate, we are seen as a strong and dependable business partner, committed to helping the Kingdom achieve its goals particularly with regard to important aspects of its national development program, including promoting the growth of SMEs and enabling Saudis to live in their own homes. For instance, we successfully reached an agreement with the Small and Medium Enterprises General Authority to enable entrepreneurs to grow their businesses. Our support for the communities we serve was again reflected through a myriad of initiatives during the year by embracing social, environmental and humanitarian activities which is listed in detail’s in this report.

On behalf of the members of the Board of Directors, the Executive Management and all our Albilad Ambassadors, I would like to express my sincere appreciation and gratitude to the Custodian of the Two Holy Mosques and his faithful Crown Prince – may Allah protect them – for their steadfast support and guidance to the banking sector. Moreover, I would like to thank the Ministry of Finance, Ministry of Commerce & Investment, Saudi Arabian Monetary Agency and Capital Market Authority for their support for the Bank's compliance with rules and regulations that ensure the stability of the Kingdom’s banking system.

To our shareholders, partners and clients, we wish to offer our gratitude for their continued loyalty and confidence.

Finally, I would like to thank our Albilad Ambassadors for their diligence and trust in us, and for the hard work that they contribute on a daily basis to make Bank Albilad such a dynamic and successful business.

CEO’s statement

Abdulaziz Mohammed AlOnaizan

Chief Executive Officer

Achieved excellent operational and financial results, by investing in information technology infrastructure and enhancing digital capabilities.

Ladies and Gentlemen, Bank Albilad Shareholders, Peace be upon you.

During 2019, Bank Albilad continued to implement its strategy of strengthening its readiness in the medium- and long- term as it achieved excellent operational and financial results, by investing in information technology infrastructure and enhancing its digital capabilities, in line with its digital transformation strategy, while ensuring information security and business continuity. Moreover, the Bank provided high quality services to its customers, enhanced operational efficiency, and supported human resources development within an attractive and stimulating work environment.

Bank Albilad performance in 2019 was driven by one clear driving force - Our absolute belief that there are significant market opportunities. The theme of this report is Platform for Growth. This is not simply a question of tapping into specific customer segments, it is also about growing the efficiency of our operations in tandem with a sensible and conservative attitude to risk, so as to guarantee our long-term stability in light of economic changes and the challenges facing the financial and banking sector.

FINANCIAL PERFORMANCE

2019 was another landmark year for Bank Albilad in terms of financial performance despite ongoing economic volatility prevailing in the region and the impact of global trade uncertainties.

The Bank’s Net Income grew 25% to SAR 1,387 million before Zakat, compared to SAR 1,110.5 million before Zakat the previous year. This was achieved on the back of total operating income growth which increased by 17% to SAR 59,363 million, resulting primarily from a significant jump in investment income by 70% to account for SAR 10,987 million. The Bank’s Total Assets grew by 17% to SAR 86,075 million, with Deposits up by 17%.

EXPAND OUR PRODUCTS AND SERVICES

The Bank endeavors to consistently provide excellent banking services through a deep understanding of customer needs and provide flexible and innovative solutions designed specifically for them. As the preferred partner for its many customers, several products and services have been developed to meet customer needs and expectations, whether through its branches located across the Kingdom or any of the Bank’s multiple online channels. Furthermore, the Bank now offers a wide range of retail and institutional financing products. In addition, the Bank has committed to actively and continuously contribute towards achieving the Kingdom’s Vision 2030 goals and aspirations.

In support of the national savings strategy, to increase the savings of Saudi households from 6% to 10% by 2030, the Bank has introduced various and innovative savings products. In addition, the Bank supports startups to increase their contribution to GDP through participation in programs and providing products for the MSME segment. Several real estate financing products and programs have also been launched, within the strategic partnership with the Ministry of Housing and the Real Estate Development Fund, aiming to increase our citizens' ownership of homes and housing units. For this, Bank Albilad has been honored as the "Best Performing Bank in Real Estate Finance 2019".

Enjaz centers, our money transfer and exchange service, continued to grow and enhance its performance by deploying self-service kiosks and POS devices. This will enable our customers to execute financial transfers immediately, in several languages, around the clock in convenient locations kingdom wide with ease and flexibility.

ENHANCE CUSTOMER EXPERIENCE THROUGH OUR OUTSTANDING SERVICES AND DIGITAL TRANSFORMATION

Our efforts are within the framework of enhancing the customer experience in using digital channels across all segments, not only by leveraging technology, but also by developing the capabilities and skills of our employees. The Bank has improved the effectiveness of communication and agility across all units, increasing the speed of decision making processes in achieving desired business outcomes and supporting change management across all levels.

As technology plays a major role in supporting the sustainable growth of our business and enhancing market position, we have invested in experienced human capital to build and developed digital channels across all businesses. The benefits of these have been seen most notably in personal banking services, thus becoming the first bank in the Kingdom to offer account opening services digitally for clients without visiting a bank branch or submitting physical documentation. In 2019, the Bank won two awards for its commitment to digital excellence.

PROMOTE A CULTURE OF OUTSTANDING PERFORMANCE AND SOCIAL RESPONSIBILITY

We believe in the importance of the relationship with the communities that we serve. We seek to employ the best talent and the Bank continuously strives to improve its work environment by creating a stimulating, evolving and attractive atmosphere for them. The Bank makes sure they are recognized. The Bank provides specialized training opportunities that motivate ambassadors to hone their talents and achieve their aspirations toward developing their careers. In addition, the Bank encourages employees to foster a strong sense of community by supporting participation in volunteer activities.

The Bank’s corporate social responsibility programs and contributions have played a significant role in achieving sustainable development to support different segments of society. Bank Albilad sponsored the Chair for Environmental Sustainability and Food Security within the CSR program of King Faisal University and the Bank was a strategic sponsor as well of the International Day of Persons with Disabilities. Bank Albilad was awarded the “Best CSR initiative” by the Global Business Outlook Awards, for its Red Sea cleanup efforts. We have also entered into a partnership with the Social Development Bank to develop and implement several savings programs that will raise awareness and foster improved attitudes towards savings amongst citizens. Above all, we recognize that we have a duty of care to the country as a whole, and to the Government, in achieving its goals and aspirations.

IN CONCLUSION

The accomplishments achieved during the past 12 months would not have been possible without the guidance of the Board of Directors and the collective efforts of the Executive Management, and of Bank Albilad Ambassadors.

We will strive to sustain this growth momentum and achieve better results in 2020 by putting more efforts to raise the level of operational efficiency and flexibility. We will continue to enhance customer experience by offering the best innovative banking solutions. The Bank will sustain its investment in modern technologies, in the development of human capital and maintain its social responsibility programs.

I extend my sincere appreciation and gratitude to the Custodian of the Two Holy Mosques and the Crown Prince - may Allah protect them - and the Saudi Arabian Monetary Authority for the great support in all aspects of the national economy and the banking sector in particular. I also extend my sincere gratitude to all the Bank’s shareholders and customers for their trust and support, which has had a profound impact on our continuous efforts to grow our business in line with their aspirations.

May Allah Bless Us All.

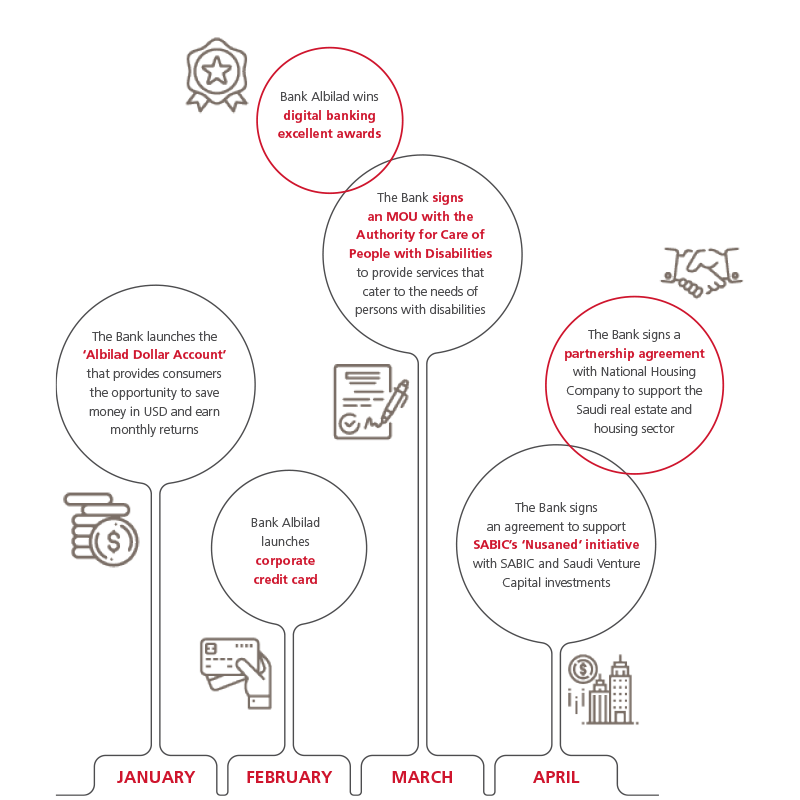

THE YEAR IN REVIEW

In 2019, Bank Albilad delivered strong financial performance despite uncertainty concerning regional economic outlook and a highly competitive environment.

It demonstrated continued progress in building a stronger, safer bank capable of delivering improved returns for shareholders.

Download PDF

THE YEAR IN REVIEW

In 2019, Bank Albilad delivered strong financial performance despite uncertainty concerning regional economic outlook and a highly competitive environment.

It demonstrated continued progress in building a stronger, safer bank capable of delivering improved returns for shareholders.

Download PDF

The growth potential of any organization is underpinned by the strength of its foundations.

Download PDF

Our Strategy

The strategy guiding Bank Albilad’s operations covers all operational segments of the bank.

Our Value Creation Story

The Bank’s value creation story reflects the value it creates for customers.

Financial review

The annual financial results of Bank Albilad ending in 31 December 2019 showcase continuous growth of profits as a result of increased Bank activity in key segments, where its Net Income before Zakat increased by 25% to SAR 1,387 million compared to SAR 1,110.5 million for the same period in 2018.

- 105,000

- 90,000

- 75,000

- 60,000

- 45,000

- 30,000

- 15,000

- -

- 2018

- 2019

- Assets

- Finance, Net

- Investments, Net

- 105,000

- 90,000

- 75,000

- 60,000

- 45,000

- 30,000

- 15,000

- -

- 2018

- 2019

- Total Liabilities

- Customer Deposits

- Total Equity

- 5,000

- 4,000

- 3,000

- 2,000

- 1,000

- -

- 2018

- 2019

- Annual Net Income

- Total Operational Income

- Total Operating Expenses

Operational Review

Bank Albilad’s operations fall into four categories: Retail, Corporate, Treasury

and Investment & Brokerage.

0%

increase in customer

registration on

online channels

0%

of all account

opened digitally

YTD

0%

increase in Mobile

Banking transactions

volume YoY

0%

increase in

Internet Banking

transactions

0%

of Aramco IPO

subscriptions managed

through digital channels

OUR MARKETPLACE

Download PDF

Human capital

Download PDF

RISK MANAGEMENT

AND COMPLIANCE

Download PDF